Tips for Creating a Budget for the First Time

You and I have something in common. We both need money to survive in the world. It seems like handling money should be easy. The calculation is simple enough. Don’t spend more than you earn, and you will go a long way toward financial security.

However, if money management is easy, why are so many people in debt? Why does money cause so much worry? According to a recent Harris Poll, 36% of couples reported that money matters caused the highest levels of stress in their relationships.

If we do not get control over our money, it will have emotional control over us. By developing a personal financial plan, you can improve your relationship with money. Managing your finances begins with establishing a budget for you and your household.

Benefits of a Home Budget

A budget helps you put money into the proper perspective. You will have a better sense of your resources and just how much you can afford to spend.

Planning for the Future

You and I both need to consider the future. Retirement may feel a long way off, but you want to be able to enjoy it when you get there. Along the way, there will be serious expenses like vehicles, a home and education. With a well-crafted budget, you can be ready for what lies ahead.

Planning for Larger Purchases

The budgeting process helps you know what you have. When it is time for a new car or another larger expense that will require a loan, your budget will guide you in determining payments you can afford and the amount you can request.

Easier Communication

Without a budget, many couples argue about money in general terms. A spouse may accuse his or her partner of spending too much on clothes but cannot define what “too much” means. With a home budget, there is an agreed-upon amount to guide the conversation.

Minimizing Debt

When you make a budget and stick to it, you will find that you rely less on credit cards, and you will be less likely to fall behind on the payments of your current debt.

Lower Levels of Stress

All of this adds up to lower stress levels for you and your family. A budget will help you worry less about money and keep you from agonizing over every purchase.

Track Your Current Spending

The first step in planning your budget is examining your current spending habits. It is helpful to look at the last few months of household bills, receipts and credit card statements.

Needs and Wants

If you are like me, one of the first things you will notice is how much you spend on items you do not need. You may have online subscriptions that you no longer use. Someone in your house may be prone to impulse buys. It is all right to spend money on your wants, but you must first determine how much is left over after you handle your needs like housing, medical expenses and food.

Irregular Expenses

Most families work with a monthly budget because most of their bills come once a month. However, everyone has expenses that come once a year or once a quarter. When you plan your expenses, you need to consider unusual bills like property taxes, insurance payments and car maintenance.

Determine Your Total Income

The next step in your budget process is figuring out how much money is coming into your household. This process is easier for some households than for others. Many people can depend on a regular salary, but other households will need to make adjustments.

Inconsistent Hours and Side Jobs

If your hours vary from week to week, your paycheck probably does as well. It is easiest to look at your average weekly hours over the year and work from that amount. You will have money set aside from busier weeks to cover expenses during weeks with less income.

If you have a second part-time job or do freelance work on the side, that income must be part of your budgeting equation. Again, the actual income may vary, so it is best to work with an average weekly or monthly amount.

Interest and Investment Income

If you already have some money set aside, you may want to let the magic of compound interest do its work. However, if you need the income to make your budget, be sure to add it. Other investments such as rental properties can also help your bottom line.

Subtract Your Necessities

Your first financial priority is meeting your basic needs. These are the things you must pay in order to survive.

There can be some wiggle room when it comes to your needs. Everyone needs food, but you don’t have to go to a restaurant every night. Everyone needs clothing, but you don’t need designer labels on everything you wear. By minimizing expenses here, you will have more available to meet your financial goals.

Establish Your Financial Goals

Your long-term goals are an important part of money management. Keeping your goals in mind will give you an incentive to stick to your plan.

Preparing for Emergencies

A recent report from the Federal Reserve Board suggests that about 40% of Americans would struggle to pay for a $400 emergency expense with cash at hand. Establishing an easily accessible fund for the unexpected is a wise plan.

A Special Purchase

Along with personal loans, setting aside funds every month is a great way to work toward a special purchase. Whether it’s a dream vacation, a new vehicle or a home improvement, saving a designated amount will put it in reach.

Investing in the Future

If you have children, you want to start saving for their educations. Several financial products such as 529 plans offer tax benefits when you put money aside. This is also the case with retirement products like IRAs. The sooner you start saving for retirement, the more options you will have as you approach that date.

Making Saving Easy

Saving money is easier if you don’t have to think about it every month. By using automatic transfers or direct deposits, you can keep yourself accountable to your plan.

Putting It All Together

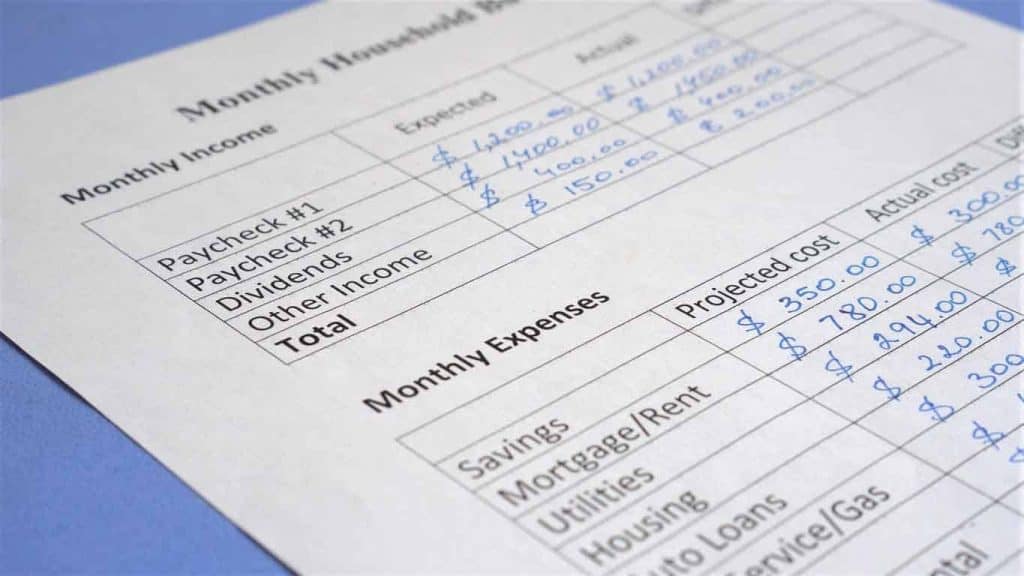

Once you have a firm grasp of your income and your expenses, you can put your budget together. Most people break their money into categories such as food, clothing and savings. There are many budget-creating apps such as Mint, Goodbudget and PocketGuard that will make the setup easier.

Getting the Project Started

- Track your expenses: There are a number of expense-tracking apps available to make this easier.

- Determine your total income: Make sure to work with your income after taxes instead of your gross income.

- Determine your financial goals: Work as a household to determine how much you want to save and why.

- Create your monthly budget: Whether you use paper and pencil, an online app or spreadsheet, the important thing is to do the work.

Review Your Progress

Like any new project, it will take a few months to get the hang of a monthly budget. With each month, you will have a better sense of both your actual income and expenses. As your budget becomes more accurate, you will find that you have greater control over your money and are closer to your financial goals. Do you have any tips that work for budgeting and saving?