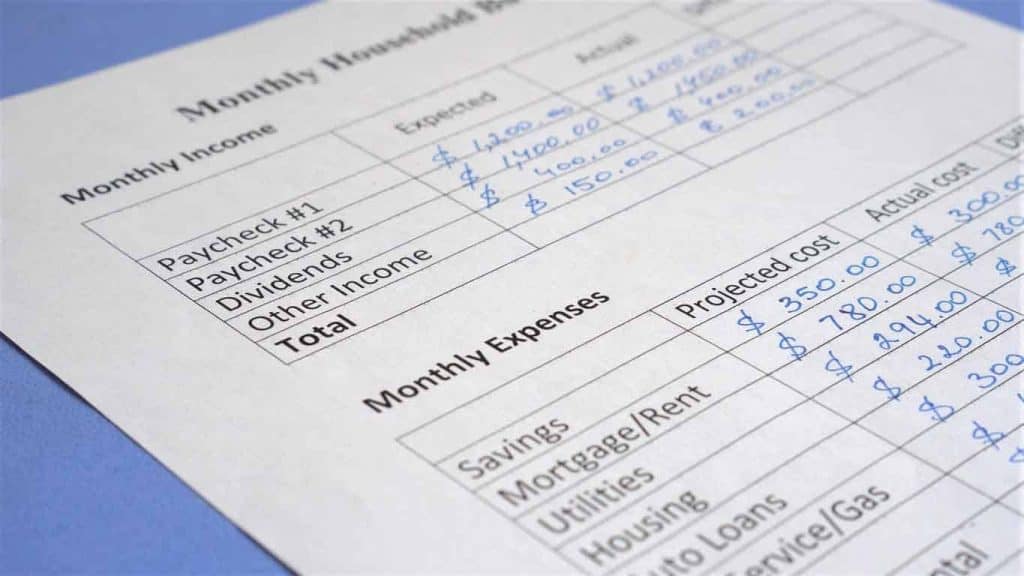

Your Last Budget

There are a million budgets out there that will help you restrict your spending, but they do not work long term. Like a really restrictive diet, you may be able to make it work for a while, but then you will bust out. It is time to consider budgeting, and money management in general, into […]

What’s the Debt-to-income Ratio?

We all know that it is important to make more money than we spend. That’s just basic economics. If you want to stay in the black, then you have to keep your spending in check. However, in real life, I know how complicated it gets. We have bills, car payments, mortgages and credit cards. Capitalism […]

How Does Solar Power Work

The sun is the largest source of energy in the galaxy, and we can benefit greatly from using this immense resource. According to researchers at Stanford’s DeepSolar Project, more than 1.5 million solar panels are being used across the U.S. alone, but how does solar power work exactly? How can a simple solar panel be […]

Take Control of Your Finances

It’s possible to get out of debt even if you have a low income. It requires that you learn the following money management techniques in this article: Acknowledge the Debt You Currently Have In order to reduce your debts, you have to know what they are. You may have been hiding from your debts, so […]

How To Get a Personal Loan to Consolidate Debt

When you apply for one large loan that you will use to pay all your smaller debts in full, this is called “consolidating your debts.” Instead of having to make several payments every month that have high interest rates, you only have one debt that has a lower interest rate than your previous debts. This […]

What Is an Unsecured Personal Loan?

If you need money, there are plenty of ways to get it. One option is to take out an unsecured personal loan. You can use the money for absolutely anything, and you are not required to supply collateral to secure the loan. Personal loans come with lower interest rates than credit cards. Loan amounts are […]

What is the Interest Rate on a Personal Loan?

What Affects Your Personal Loan Rates? If you’re considering a personal loan, you’re not alone. Over 20 million Americans have taken out personal loans as of 2019, according to Experian. About Personal Loans A personal loan is an interest rate loan in which you borrow a fixed amount. You repay the loan in monthly installments […]

How To Get a Personal Loan With No Credit and No Consigner

Getting a personal loan with no credit history and no cosigner can be difficult, but there are always options available. While you may not get approved for a large loan with a traditional bank, you can find a bad credit loan or no credit loan through other types of lenders. If you’re willing to put […]

How To Handle Debt

Right now, consumers hold $13.86 trillion in debt in the United States. While accessing loans is useful, paying them back can be stressful. If you get into too much debt, you may need debt or credit card help to manage your debt responsibly. By taking control of your debt, you can reduce the amount you […]

Creating a Budget for the First Time

Tips for Creating a Budget for the First Time You and I have something in common. We both need money to survive in the world. It seems like handling money should be easy. The calculation is simple enough. Don’t spend more than you earn, and you will go a long way toward financial security. However, […]