How Long Does It Takes to Get a Personal Loan?

If you need cash fast, you need to choose the right lender. You can get approved for a personal loan in just a few hours, but some lenders can take weeks to make a decision. Once you are officially approved, the money still has to be sent to your account. By finding the right lender, […]

What is a Good Interest Rate on a Personal Loan?

Whether you want to consolidate your debt or are getting ready to complete a renovation on your home, a personal loan can provide you with the money you need to complete these projects. When you and I are searching for the right loan, the interest rate should be the most important factor in the decision. […]

Personal Finance in a Pandemic

Without anyone telling us, you and I know that the coronavirus pandemic has wrecked our financial lives. When your job disappears, the income that you had last year no longer shows up as deposits to your bank account or IRA. The economic fallout can destroy our family budgets. Finding a Way Around the Shortfall News […]

Pros and Cons of a Cash Out Loan Refinance

Pros and Cons of a Cash-Out Refinance If you need money or would like to redo your mortgage, a cash-out refinance could be the right choice for you. Some people hear about this option and jump into the process before they know what’s involved. They are often pleased with the outcome, but some of them […]

How To Handle Debt

Right now, consumers hold $13.86 trillion in debt in the United States. While accessing loans is useful, paying them back can be stressful. If you get into too much debt, you may need debt or credit card help to manage your debt responsibly. By taking control of your debt, you can reduce the amount you […]

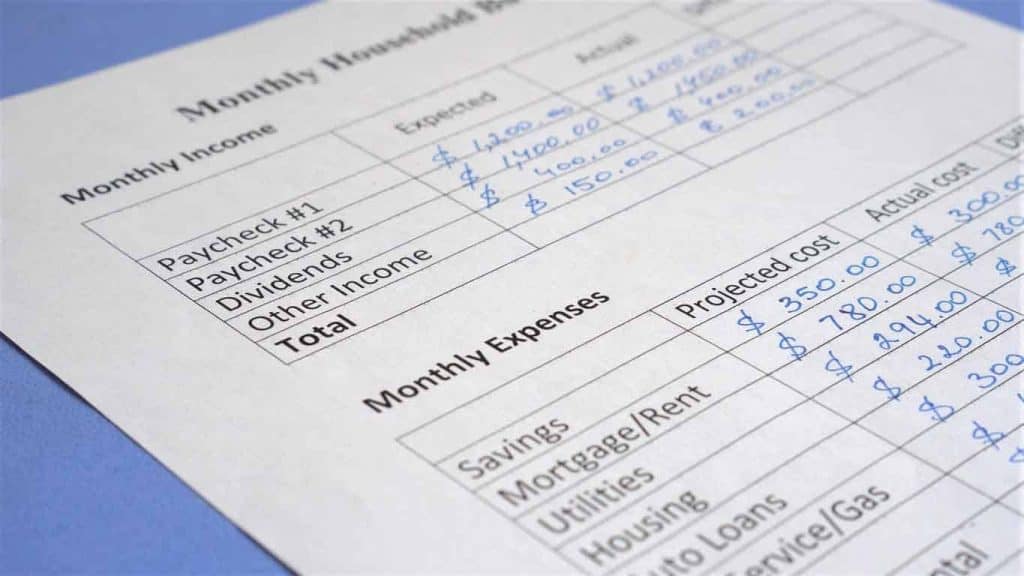

Creating a Budget for the First Time

Tips for Creating a Budget for the First Time You and I have something in common. We both need money to survive in the world. It seems like handling money should be easy. The calculation is simple enough. Don’t spend more than you earn, and you will go a long way toward financial security. However, […]

How to Get a Loan When You Are Unemployed

Many people are currently facing unemployment, and some might wonder whether they can qualify for an unemployment loan. According to the U.S. Bureau of Labor Statistics, the civilian unemployment rate as of May 2020 is 14.7%. Qualifying for a loan while being unemployed is possible as long as you have good credit and another income […]

Ins and Outs of Payroll Loans

The Ins and Outs of Payroll Loans Payroll loans are for business owners who need quick funds to cover payroll expenses. When employers do not have enough cash to make payroll, they must move assets, restructure or look for credit solutions. According to the Department of Labor, failing to pay employees is a violation of […]

Increase Your Loan Eligibility

Taking out a personal loan can be a helpful way to make a big purchase, consolidate your debt, or strengthen your credit history. Getting approved is not always easy, though. Lenders take a number of factors into consideration when you apply for a loan, and there’s never a guarantee that you’ll be approved. You can […]

Short Term Loan Solutions

If you don’t have an emergency fund, you are not alone. According to Bankrate, 28 percent of American adults do not have a rainy day fund, but an unexpected expense can come up at any time. If none of the people in your circle would be able to lend you the money you need for […]